Some landlords have been speaking

to me recently about stories in the press and their concerns about booming

house prices and the next housing bubble in Kingston. In the past few years, if

you were going to be buying soon in Kingston, it was vital to ensure you build

in some capital growth by buying cheaply or finding a way to add value. Interestingly, property values in Kingston

upon Thames have increased by an impressive 6.2% in the last 12 months. So are properties too expensive?

Looking at the market and looking

at every property sale in Kingston upon Thames that sold in 2007 and again in

the last few months of 2014, property values are on average 23.1% higher in Kingston

upon Thames than they were in 2007, which was the last boom year before they

dropped by 19% during 2008 and 2009. On

the face of it, a 6.2% increase over the last 12 months in Kingston upon Thames

property values is impressive, especially as those same property values are 23.1%

higher than the boom of 2007. Does this

suggest properties are too expensive in Kingston upon Thames?

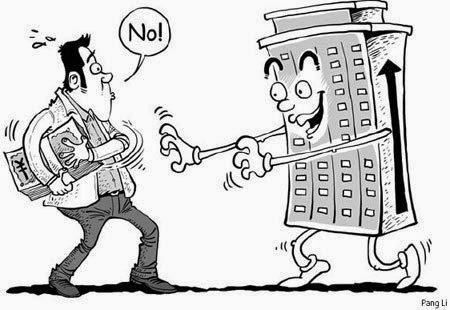

Well, the answer is both Yes and

No. Yes, the headline price that the property sells for Kingston is 23.1%

higher than 2007, yet No, because these headline figures don't take into

account inflation. Since 2007, inflation has risen by around 19%. So instead of

property values being 23.1% more expensive than the 2007 boom, they are in fact

only 4.1% (IN REAL TERMS) more expensive than the boom (19% less 23.1% equates to 4.1%). People

think inflation is a bad thing, eating away at the real value of your savings.

It can however, be advantageous to property investors.

My answer to landlords is get the

best advice and opinion you can. Speak to me, speak to others, do your homework

and drive a hard bargain when buying, thus ensuring that you are in pole position.

March 2014

March 2014

No comments:

Post a Comment